Over the past year, prices have decreased for both imported and Russian crawler excavators. Let’s take a look at who is leading the market today and under what conditions their products can be purchased.

The data is based on an analysis of current listings published in September 2025 on Russia’s largest online platforms (Avito, Ekskavator.ru, Drom) and supplemented with information from official dealers’ websites. In cases where sellers link equipment prices to the current U.S. dollar or euro exchange rate, the calculations use the average ruble exchange rate for the month.

Market Structure: Countries and Brands

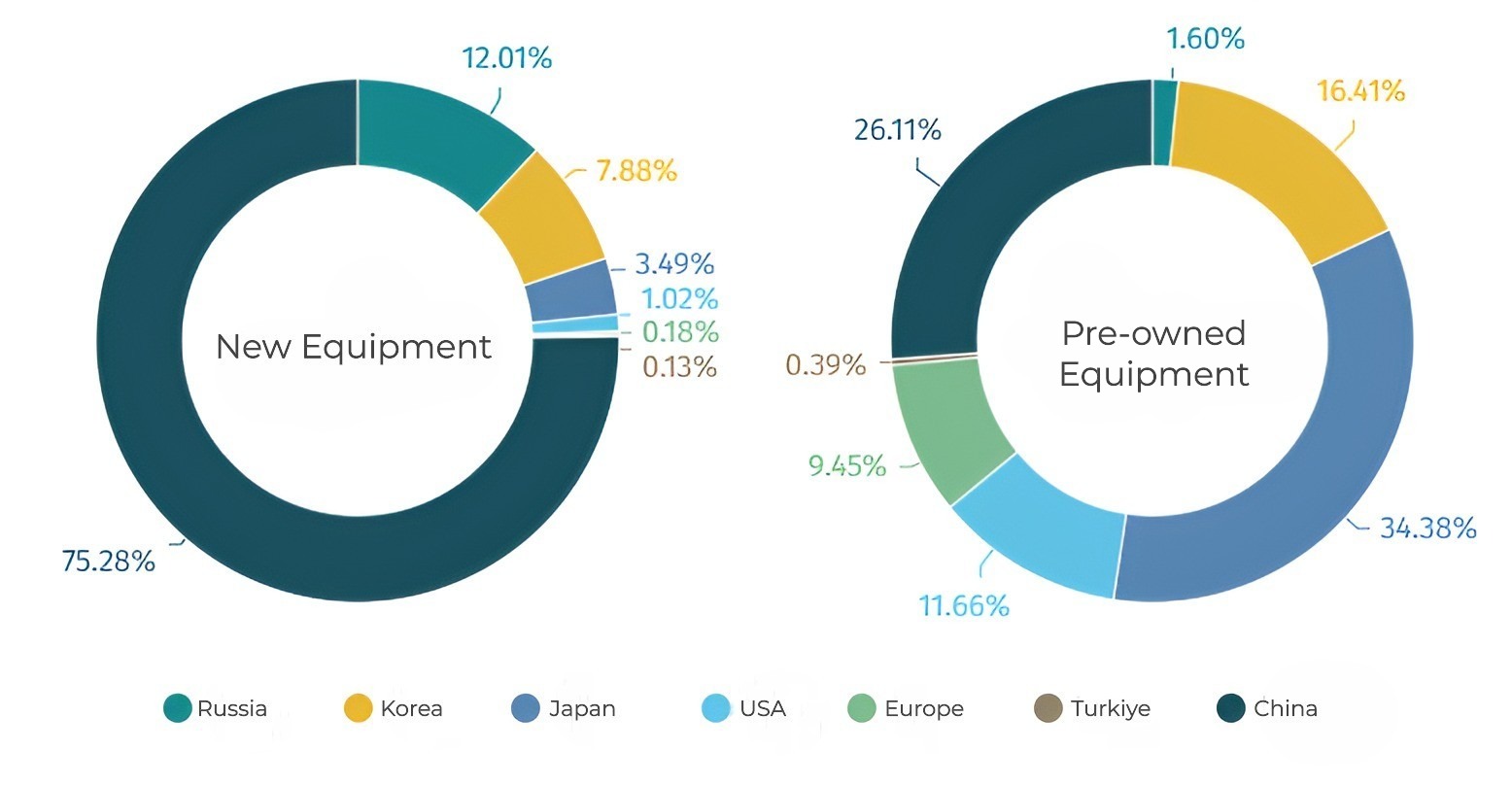

China accounted for 75.3% of listings in the new equipment segment and 26.1% among pre-owned machines. A year earlier, the share of Chinese pre-owned excavators was much smaller at just 3.9%.

Suppliers of Russian-made equipment have also become more active on trading platforms: the share of domestic excavators now stands at 12% and 1.6%, respectively, compared to 1.8% and 2.2% a year earlier.

Distribution of Equipment Sale Listings by Region

The data is based on an analysis of current listings published in September 2025 on Russia’s largest online platforms (Avito, Ekskavator.ru, Drom) and supplemented with information from official dealers’ websites. In cases where sellers link equipment prices to the current U.S. dollar or euro exchange rate, the calculations use the average ruble exchange rate for the month.

- The share of Chinese brands in the pre-owned equipment market has increased from 3.9% to 26.1%.

- The most active suppliers on trading platforms are LONKING, LGCE, and LIUGONG.

- Most market segments are showing a price decline of up to 33%.

Market Structure: Countries and Brands

China accounted for 75.3% of listings in the new equipment segment and 26.1% among pre-owned machines. A year earlier, the share of Chinese pre-owned excavators was much smaller at just 3.9%.

Suppliers of Russian-made equipment have also become more active on trading platforms: the share of domestic excavators now stands at 12% and 1.6%, respectively, compared to 1.8% and 2.2% a year earlier.

Distribution of Equipment Sale Listings by Region

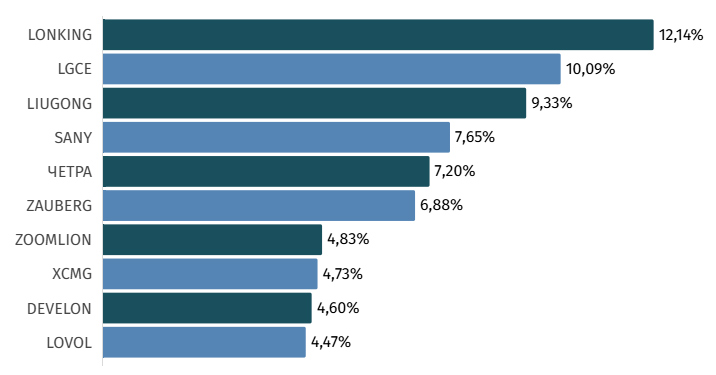

Seven of the top ten new equipment manufacturers are Chinese companies. The remaining leaders include CHETRA (Russia), ZAUBERG (a joint Russian-Chinese company), and DEVELON (Korea).

Top 10 Brands in Russia (New Equipment)

Top 10 Brands in Russia (New Equipment)

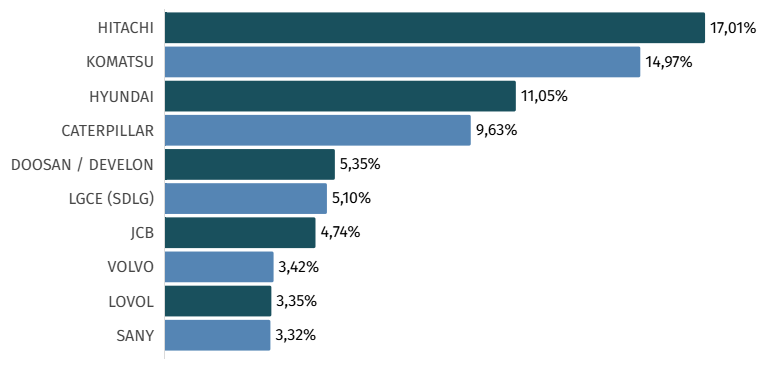

The pre-owned equipment market still features many non-Chinese names. The top two positions, just like a year ago, are held by two Japanese manufacturers — HITACHI and KOMATSU. They are followed by the Korean machinery producer HYUNDAI.

Top 10 Brands in Russia (Pre-Owned Equipment)

Top 10 Brands in Russia (Pre-Owned Equipment)

Price Factor: Cost of Crawler Excavators Depending on Region of Manufacture and Year of Production

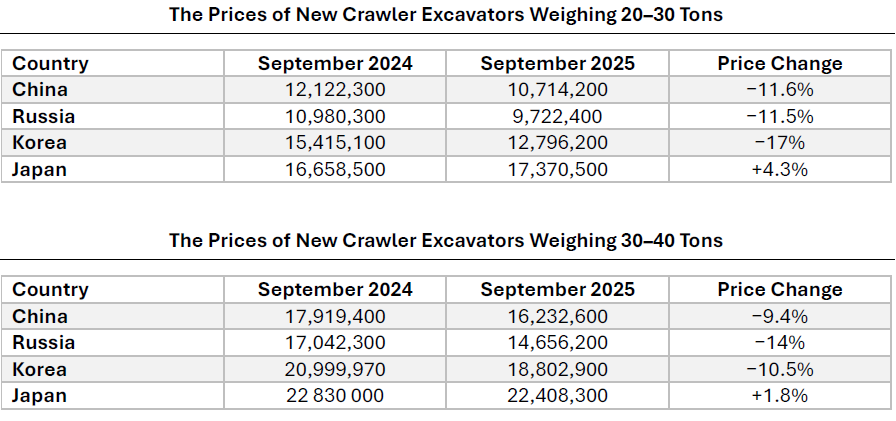

The prices of excavators from China, Korea, and Russia have decreased over the past year. For China and Korea, the main reasons were the strengthening of the ruble, a decline in demand, and excess inventory at dealer warehouses. In the case of Russian-made products, government support measures also played a role.

The most significant changes were seen in the average prices of Korean-brand excavators in the 20–30 ton class (−17%) and Russian models weighing 30–40 tons (−14%).

Prices for Japanese machines remained roughly at the same level: in the 20–30 ton class, there was an increase of 4.3%, while in the 30–40 ton class, a decrease of 1.8% was recorded.

The prices of excavators from China, Korea, and Russia have decreased over the past year. For China and Korea, the main reasons were the strengthening of the ruble, a decline in demand, and excess inventory at dealer warehouses. In the case of Russian-made products, government support measures also played a role.

The most significant changes were seen in the average prices of Korean-brand excavators in the 20–30 ton class (−17%) and Russian models weighing 30–40 tons (−14%).

Prices for Japanese machines remained roughly at the same level: in the 20–30 ton class, there was an increase of 4.3%, while in the 30–40 ton class, a decrease of 1.8% was recorded.

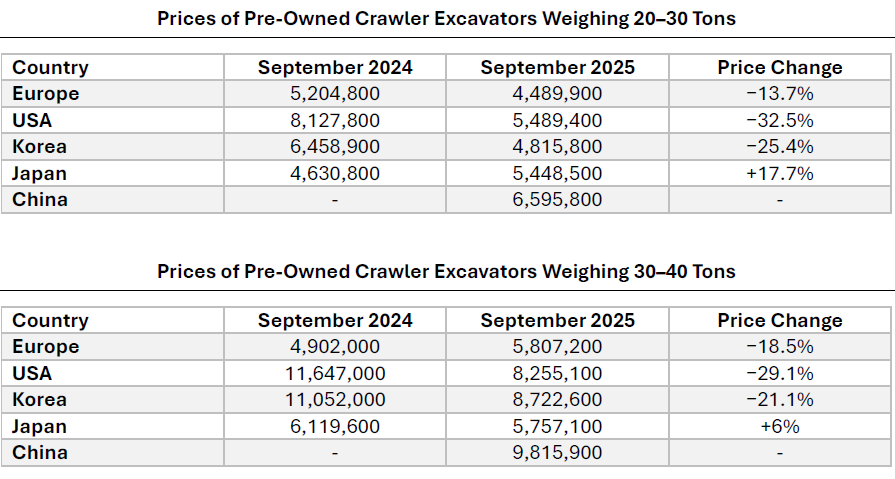

In the pre-owned equipment market, the overall trend of declining average prices continues. However, there are segments where prices have increased: Japanese excavators weighing 20–30 tons (+17.7%) and European machines weighing 30–40 tons (+18.5%).

The most significant price drop was recorded for American brands, with values decreasing by up to 32.5%. In contrast, the trend in 2024 was the opposite, when prices had risen by as much as 20%.

This year, pre-owned Chinese excavators were included in the charts for the first time. While previously machines from China were mainly represented in the new equipment segment, this time a notable number appeared among pre-owned listings as well. Most of these machines were manufactured between 2021 and 2023.

The most significant price drop was recorded for American brands, with values decreasing by up to 32.5%. In contrast, the trend in 2024 was the opposite, when prices had risen by as much as 20%.

This year, pre-owned Chinese excavators were included in the charts for the first time. While previously machines from China were mainly represented in the new equipment segment, this time a notable number appeared among pre-owned listings as well. Most of these machines were manufactured between 2021 and 2023.

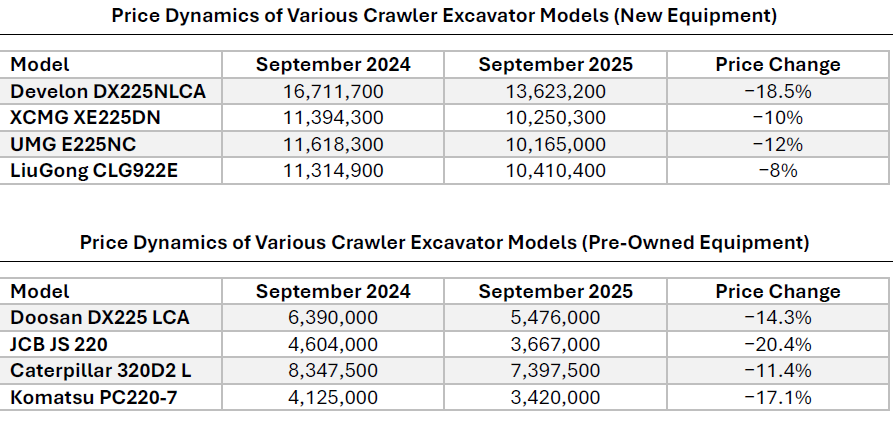

The price dynamics of individual models reflect overall market trends: all excavator models analyzed have become less expensive. The most notable decreases were recorded for the Korean Develon DX225NLCA (new equipment, −18.5%) and the European JCB JS 220 (pre-owned equipment, −20.4%).

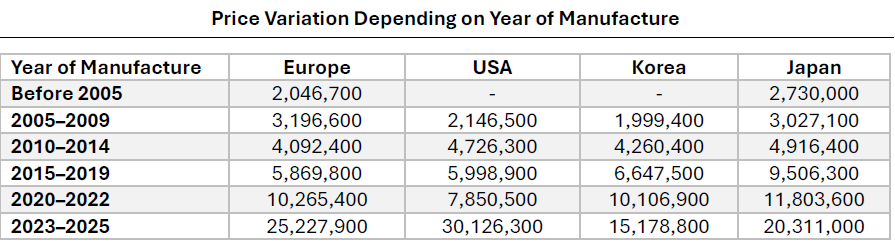

The oldest excavators available on the market come from Europe and Japan. Equipment from these countries produced before 2005 could be purchased for an average of 2,046,700 and 2,730,000 rubles, respectively. At the same time, Korean machines manufactured between 2005 and 2009 turned out to be even more affordable, with an average price of 1,999,400 rubles.

Among the factors that will continue to influence the cost of new construction equipment are the projected depreciation of the Russian ruble, an increase in the scrappage fee (in 2025, rates for crawler excavators have not been raised), and the effectiveness of government support measures.

At the same time, for pre-owned “Western” machines, a further price decline can be expected due to the aging of the equipment fleet.

Ekskavator.ru will continue to monitor the market situation.

At the same time, for pre-owned “Western” machines, a further price decline can be expected due to the aging of the equipment fleet.

Ekskavator.ru will continue to monitor the market situation.